All You Need To Know About VAT In UAE On Football Ticketing from UK

2026-01-28

While ticketing incidents between two parties located in different countries may seem rather straightforward, some companies in the UAE assume that because the actual event was held overseas, it does not incur VAT in the UAE. Unfortunately, this is a common, and very expensive mistake that occurs frequently when the FTA (Federal Tax Authority) performs an audit.

The purpose of this blog is to illustrate the normal ticketing structure between a company in the UAE, and one in the UK, for football matches and subsequently clarifying where Vat obligations arise in UAE, based on the guidelines used by the FTA.

In this example, we are going to use a simple example of the normal football ticketing structure for a company in the UAE:

Is a company based in the UAE subject to UAE VAT?

The question is therefore: Is it VAT and how much?

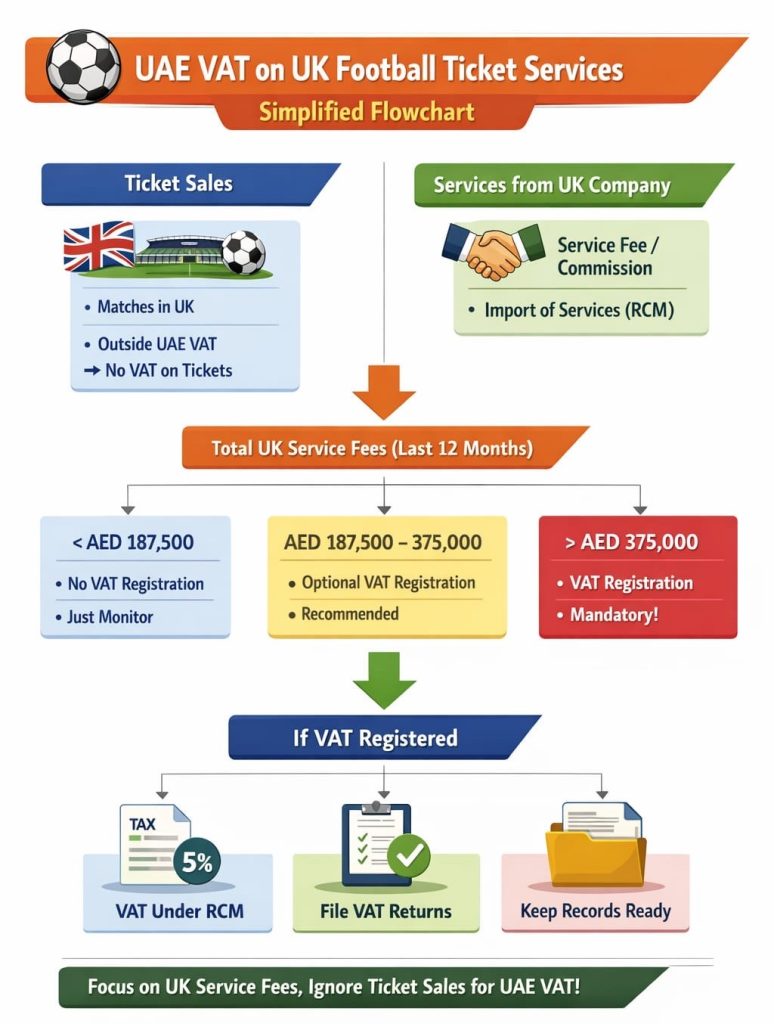

Since the matches are held in the UK:

This point is generally clear and rarely disputed.

The review consists of far more than the sale of the tickets. In most situations, there is also an associated service flow relating to:

Generally, these services are supplied to the U.A.E. company by the U.K. company. Each supply must be evaluated independently pursuant to UAE VAT laws, and larger portions of the error occur when businesses fail to account for the service leg of the structure.

If:

The result is as follows:

It is important to understand that the true trigger for UAE VAT in this structure is the imported service, not the ticket sale.

Registration for VAT is determined by the value of imported services, not the values of ticket sales. For purposes of determining if a company needs to register for VAT:

Many UAE entities fall into registration obligations without realizing it, purely due to recurring imported services.

The process of reclaiming VAT paid under the reverse charge mechanism (RCM) is not automatic. It is only possible to claim back VAT paid under RCM if:

On paper, it appears possible to reclaim VAT on the supply of admission tickets, as it is not an exempt activity, but in practice the situation becomes complicated when taken into account with the FTC/FTA theory.

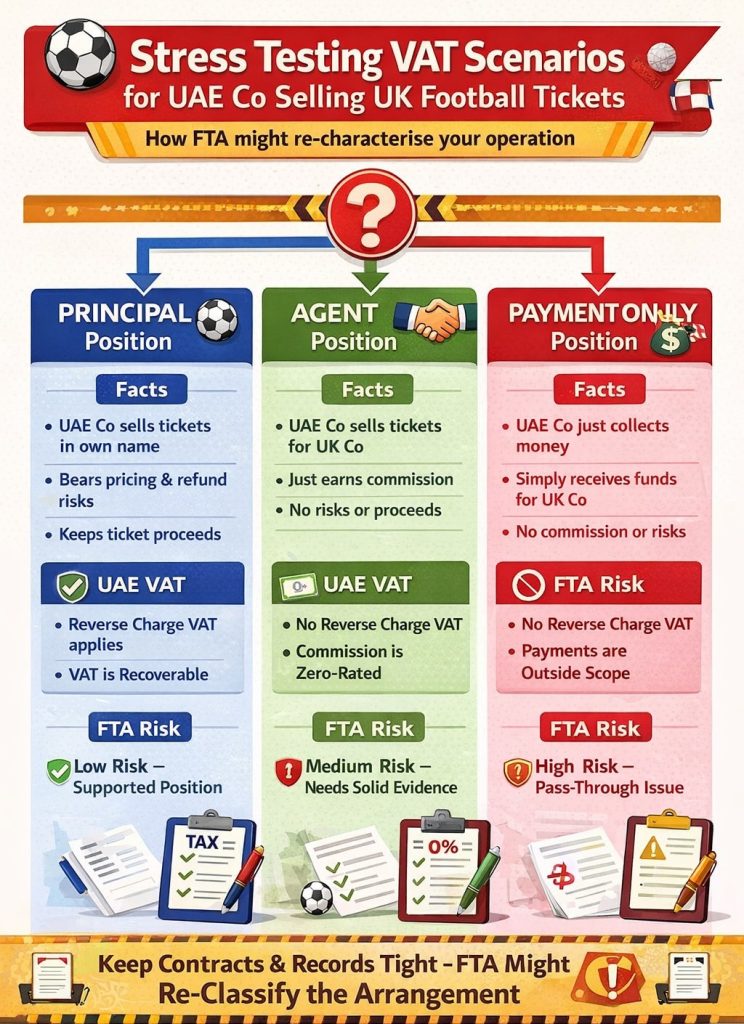

The FTA does not simply rely on labels, flow diagrams and banking flows to establish the position; it applies a commercial substance stress test to establish the answer. The key question becomes “what is an UAE company in substance?”.

Indicators of this position:

• Tickets are sold in the UAE Company’s own name;

• Price is controlled by the UAE Company;

• Risk of refunds and inventory rests with the UAE Company;

• Proceeds from the sale of tickets remain with the UAE Company;

Outcome for VAT: Reverse charge mechanism will apply to services provided by the UK, therefore there will generally be support from the VAT for recovery; it may also be necessary for the UAE Company to register for VAT if the threshold limit has been exceeded;

Comments: This is the strongest and most demanding position regarding the contract, risk allocation, and actual conduct must be closely aligned.

Indicators

VAT Outcome

Comment: Often the most VAT-efficient structure but only if contracts and operations are impeccably clean.

Indicators

VAT Outcome

Comment: This is the highest audit-risk scenario if facts are weak or undocumented. The FTA frequently re-characterises such arrangements.

The majority of businesses have the misconception that “All ticket sales fall outside of VAT so, therefore, the UAE company’s activities fall outside of UAE VAT.” This is incorrect. VAT supports the following:

1. Substance over form

2. Contracts over Bank Accounts

3. Risk and Control over Accounting Entries

For this reason, when you ignore the Service Leg (or Characterise this Role differently), you may incur additional assessments for your services, penalties, and you may also deny the right to recover input VAT paid.

Ticket Sales are excluded from VAT Analysis if the Tickets were sold by your company, NOT a UAE Company (like your parent).

Imported Services frequently (but not always) provide a “doorway” into VAT Registration (by your Company) and recovery of VAT incurred in importing services and supplies into the UAE; but you must also consider:

Engaging professional vat advisory in dubai is strongly recommended for businesses operating cross-border ticketing models to ensure defensibility during audits.

In the case of cross-border ticketing structures, VAT risk does not arise from where the match is played, but rather from the business structure and operations. How you are positioned on principal versus agent versus payment collector on paper and in actual practice will determine how defensible the business structure will be under an FTA audit.

No. Football ticket sales for matches held outside the UAE are outside the scope of UAE VAT. As a result, no UAE output VAT is charged on the ticket sales, and these sales do not count toward UAE VAT registration thresholds.

VAT risk arises from the services associated with ticketing, such as sourcing, booking facilitation, and operational support. When these services are supplied by a UK company to a UAE company, they may be treated as imported services and become subject to UAE VAT under the reverse charge mechanism.

The reverse charge mechanism applies when services are supplied by a non-UAE supplier to a UAE-established business. In football ticketing structures, services provided by the UK company to the UAE company are treated as supplied in the UAE, requiring the UAE company to account for VAT under RCM.

Yes. Imported services subject to the reverse charge mechanism must be included when assessing VAT registration requirements. If the value of these services exceeds AED 375,000 in a rolling 12-month period, VAT registration becomes mandatory.

VAT paid under RCM can only be recovered if the imported services are used to make a taxable supply. While ticket sales are not an exempt activity, VAT recovery depends on the UAE company’s true commercial role and how the FTA characterises the business.

The FTA applies a commercial substance test rather than relying solely on contracts or bank flows. It examines factors such as pricing control, ownership of risk, entitlement to proceeds, and operational responsibility to determine the true role of the UAE company for VAT purposes.